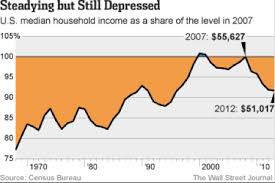

I guess I am just tired of hearing how good it is when most Americans and Oregonians have yet to experience an economic recovery.

The slow recovery has been blamed on a number of factors (Bush of course) with weather and jobs being the main culprits. Like weather hasn’t been around since man emerged from the hunter-gatherer stage. And with jobs we are just fine with waiters and hotel clerks replacing higher paying executive and engineering jobs. And the middle class, we just sort of rediscovered them after they finally decided the new normal was a good excuse for a new Senate.

Most troubling from my perspective is the housing industry. The headlines continuously proclaim housing is in recovery. Their main focus has been on housing prices which have been increased given the incessant Federal Reserves QE “infinity” programs and Federal initiatives like HAMP, HARP which have spent $billions to modify mortgages and prevent foreclosure. But continuous rumors of recidivism hampering foreclosure prevention programs undermine Administration claims of success.

Yet the fundamentals of the industry are far from solid. Sales of homes remain at 2009 -2010 levels. Existing sales announced this last week were at 8 month lows. Financing is nebulous. Applications have declined massively and purchase applications are dismal. Lack of financing is a primary concern with dependence on government sources dominant. Underwriting standards are unrealistic and dictated by the CFPB, requiring credit ratings in the 700 – 750 range as a minimum.

More recently given the flailing real estate sales market, Fannie, Freddie, and the FHA have reverted to “sub-prime” financing in an effort to revive the failing residential capital markets. Sub-prime financing, this time exclusively at the hands of government controlled lending sources has returned. Mortgage Financing provided is 95% of value and higher, with little regard for the risk of default. Worse, the Federal Government is on the verge of re-instituting European Accounting and Banking Standards (Basel Accords) which at best amplified the financial crisis in 2008. These International Standards seem more an attempt to liquefy the international monetary system than provide security to the domestic real estate industry and mortgage financing system.

Pete the Banker is a Banker who wishes to remain anonymous after what happened to Joe the Plumber by the President and his shock troops in the 2008 election. He is a member of the Victoria Taft Blogforce.