Regulation Tied to Big Time Layoffs in the Mortgage Industry

Mortgage applications have fallen off by 13.5% last week. It seems that foreclosures also likely to climb again! The refinancing index slumped 20.2 percent to 1,528.5, off 71 percent since its 2013 high in May and now at its lowest since June 2009, another sign that higher interest rates are starting to hit homeowners. Interesting how housing figures always seem to revert to June, 2009. How much has been spent by the Feds since then, not to mention the massive Federal Reserve effort? How many iterations of Administration programs have we had?

The slide is coming at a time that The Fed Chairman Bob Bernanke is considering putting the

brakes on quantitative easing. From CNBC,

The data come just a week before U.S. Federal Reserve policymakers meet to consider slowing a massive bond-buying program, which includes purchases of mortgage-backed securities.

The Fed’s support has been a major factor in boosting home prices in the United States after a slump during the crisis, and many economists worry that a pullback now may set back the housing market’s nascent recovery.

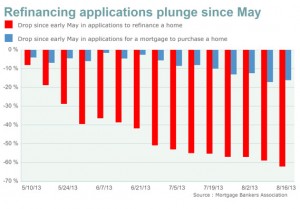

The chart nearby from Market Watch shows the decline in both refinance and purchase applications since last May. Policy makers were anticipating that home purchase applications would fill any void left by lower refinance activity, yet home purchase applications have also declined.

Investor cash purchase activity has similarly declined. So where is the money/demand supposed to come from now?

But whatever recovery exists is rickety at best. The Mortgage industry is laying off in droves in part due to their past wrongs and current government regulation.

Some banks are reducing staff for other reasons, such as impending regulations.

According to Nora Calley writing for the Mortgage Orb, a trade publication,

Dustin Hobbs, communications director for the California Mortgage Bankers Association, says some banks are reducing staff for other reasons, such as impending regulations. “A lot of banks, in an atmosphere of heightened regulation and scrutiny, look to reduce risk,” he says. “They are shoring up their assets and balance sheets, selling mortgage servicing rights, and reducing their exposure.”

And here’s the background:

That hints at an improved economy, but there is more to the story, says Frank T. Pallotta, managing partner at Rumson, N.J.-based Loan Value Group. The number of foreclosures slowed down over the last couple of years because banks were responding to the National Mortgage Settlement.

“The state attorney generals [sic] were telling the largest five servicers, ‘We are penalizing you for the job you did, and you have to pay for your errors of the past and fix your operations,'” Pallotta says.

The settlement required JPMorgan Chase, Citigroup, Wells Fargo, Bank of America Corp. and ResCap (formerly Ally Financial) to dedicate a total of $20 billion to principal reduction, refinancing and other forms of relief. “What they did is they stopped the presses,” Pallotta says. “They stopped foreclosures, and they stopped their aggressive collection measures. Foreclosures are down because banks had to fix what was broken.”

The US housing industry continues its bumpy ride and the mass media aren’t reporting it.